Trade Size - Position Sizing Calculator for Stocks

Are You Under or Over Trading?

Proper position sizing and risk management is the key to making consistent profits in the stock market. Most people think trading is all about looking for the perfect stock and timing your entry perfectly. But in fact, a system with random entries can be profitable as long as you have good money management rules and follow the golden rule of trading, let your profits run and cut your losses short.

How much risk can you tolerate on each trade?

==================================

Trade Size implements a Percentage Risk Model that ensures you don’t lose more than a predetermined percentage of your trading equity on any given trade. Traders use this approach to determine their position sizes.

What do you need to know to calculate your position size based on the Percentage Risk Model?

- Your Total Capital or Account Balance

- The Percentage of your capital that you’re prepared to risk (0.5%, 1.0% or 2%)

- The Initial Stop Loss Price. In a Long position this means how much should a stock go down before you exit a trade.

- The Entry Price at which you will enter the trade.

Features

=======

- Beautiful User Interface designed to maximize user input and information display.

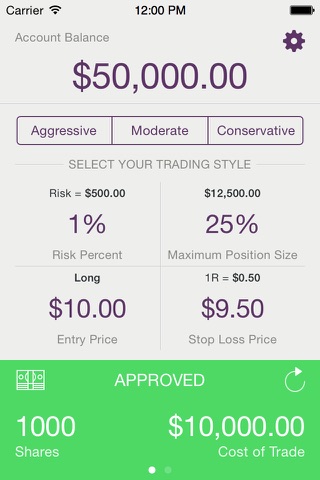

- Uses a Percentage Risk Model to calculate position sizes.

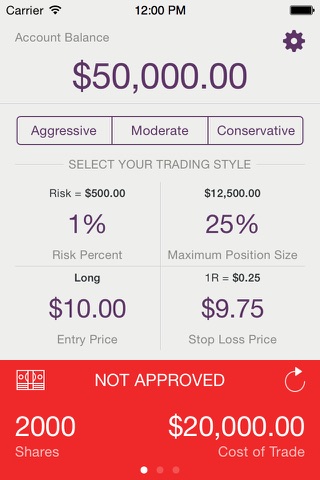

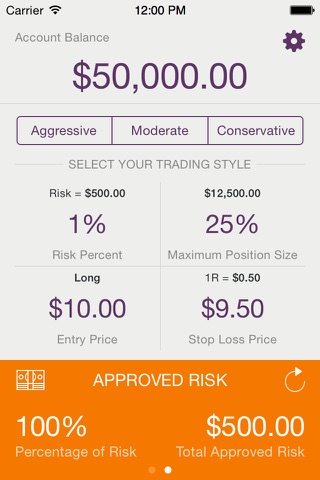

- Uses Maximum Position Size to let the user know if a Trade is Approved or Not Approved.

- When a trade is Not Approved it shows the number of Allowed Shares and Risk based on the Maximum Position Size.

- Save settings based on three custom Trading Profiles — Aggressive, Moderate and Conservative.

- Takes broker commissions into account when calculating the position size and cost of trade.

- Supports Long and Short Trades.

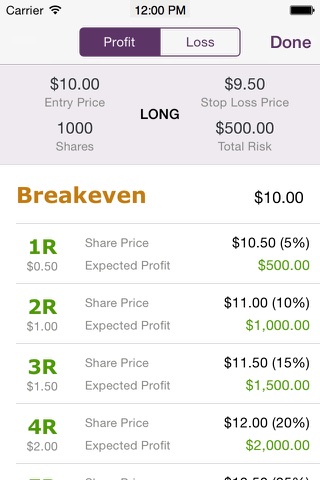

- Profit / Loss Projections using R-Multiples and Percentages.

- Calculates the Breakeven price after broker commissions.

- Compatible with iPhone 6 and iPhone 6 Plus